-

Project Title

AlgoTradeFlow: Advanced Algorithmic Trading System

-

Timeline:

20 Days

-

Tech Stack:

Python

-

Demo Link:

-

Client Name:

Project Detail:

AlgoTradeFlow is an automated trading system designed to execute high-speed trades based on predefined algorithms. It aims to capitalize on market inefficiencies and trends, delivering consistent returns while minimizing manual intervention and errors.

Problem Statement:

Traditional manual trading is not only time-consuming but also prone to emotional biases and can't capture the minute market inefficiencies that might arise in split seconds. Additionally, the dynamic and fast-paced nature of modern financial markets demands tools that can instantly react to market data and news.

Solution:

We developed an algorithmic trading system that uses quantitative models and strategies to identify trading opportunities. Leveraging real-time market data feeds, our algorithms make swift buy/sell decisions, ensuring timely execution and optimizing profit margins.

Features:

- Real-time Sentiment Scoring: Continuous evaluation of financial sentiments from multiple sources.

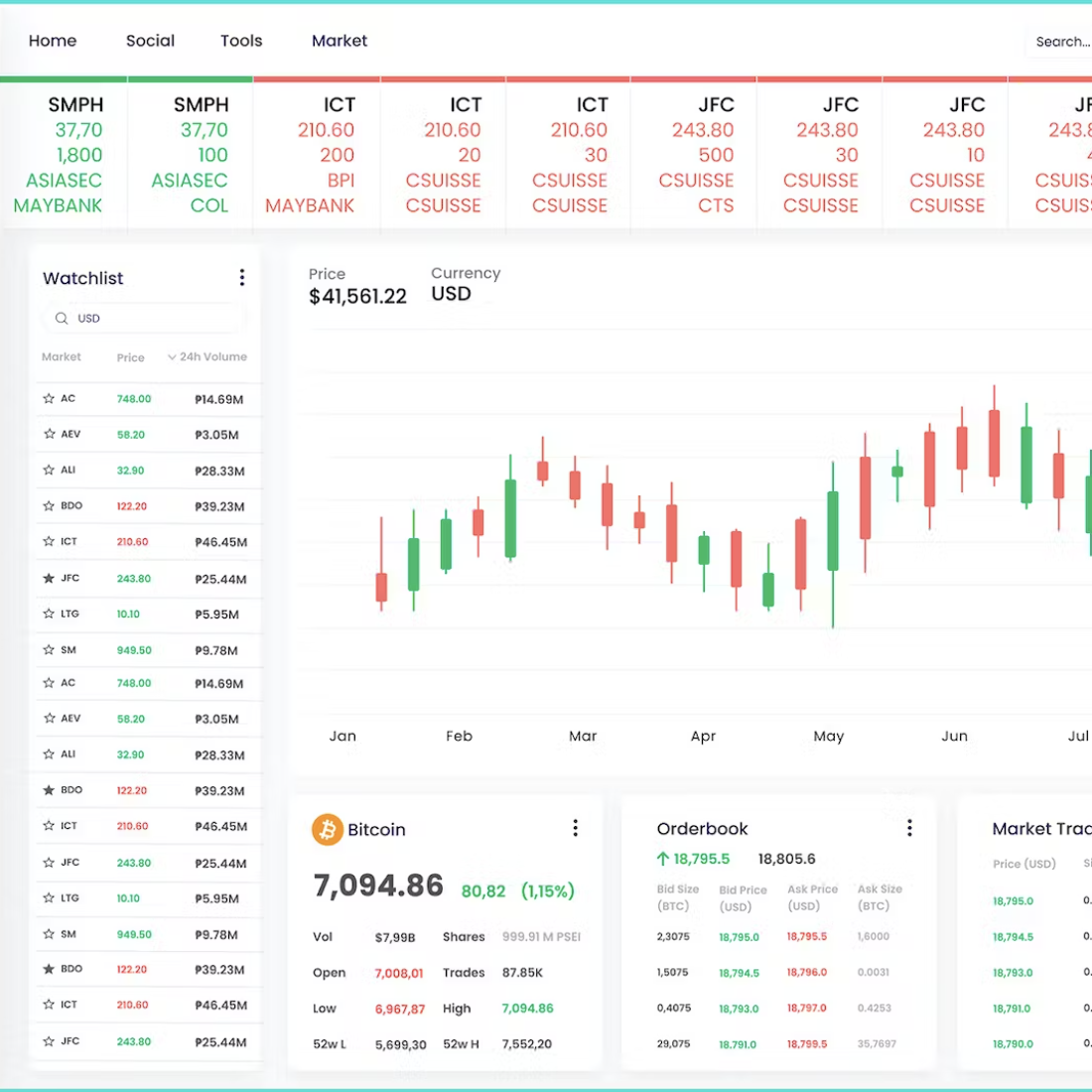

- Interactive Dashboards: Visualization tools for a quick assessment of the market mood.

- Alert System: Notification system for drastic sentiment shifts.

- Historical Sentiment Analysis: Archive and review past sentiments and correlate with market movements.

Use Cases:

- Investment Strategy: Tailor investment strategies based on prevailing market sentiment.

- Risk Management: Adjust financial portfolios in response to sudden negative sentiment spikes.

- Market Prediction: Anticipate market movements by correlating sentiment with historical market behavior.

Data Science Specific Points:

- Data Collection: Implemented web scraping tools to collect data from financial news websites, blogs, and social media platforms. Utilized APIs, where available, especially for platforms like Twitter.

- Data Analysis: Text data underwent preprocessing (tokenization, stemming, etc.) followed by sentiment classification using deep learning models and natural language processing techniques.

- Results: The system successfully identified sentiment trends in correlation with market movements, achieving an 87% accuracy rate in sentiment classification, leading to enhanced market prediction capabilities for our users.

Technologies Used:

- Programming Languages: Python, SQL

- Frameworks: TensorFlow, NLTK, spaCy

- Tools: Elasticsearch, Kibana, Web Scraping tools (BeautifulSoup, Scrapy)

- Databases: Google Cloud Databases