-

Project Title

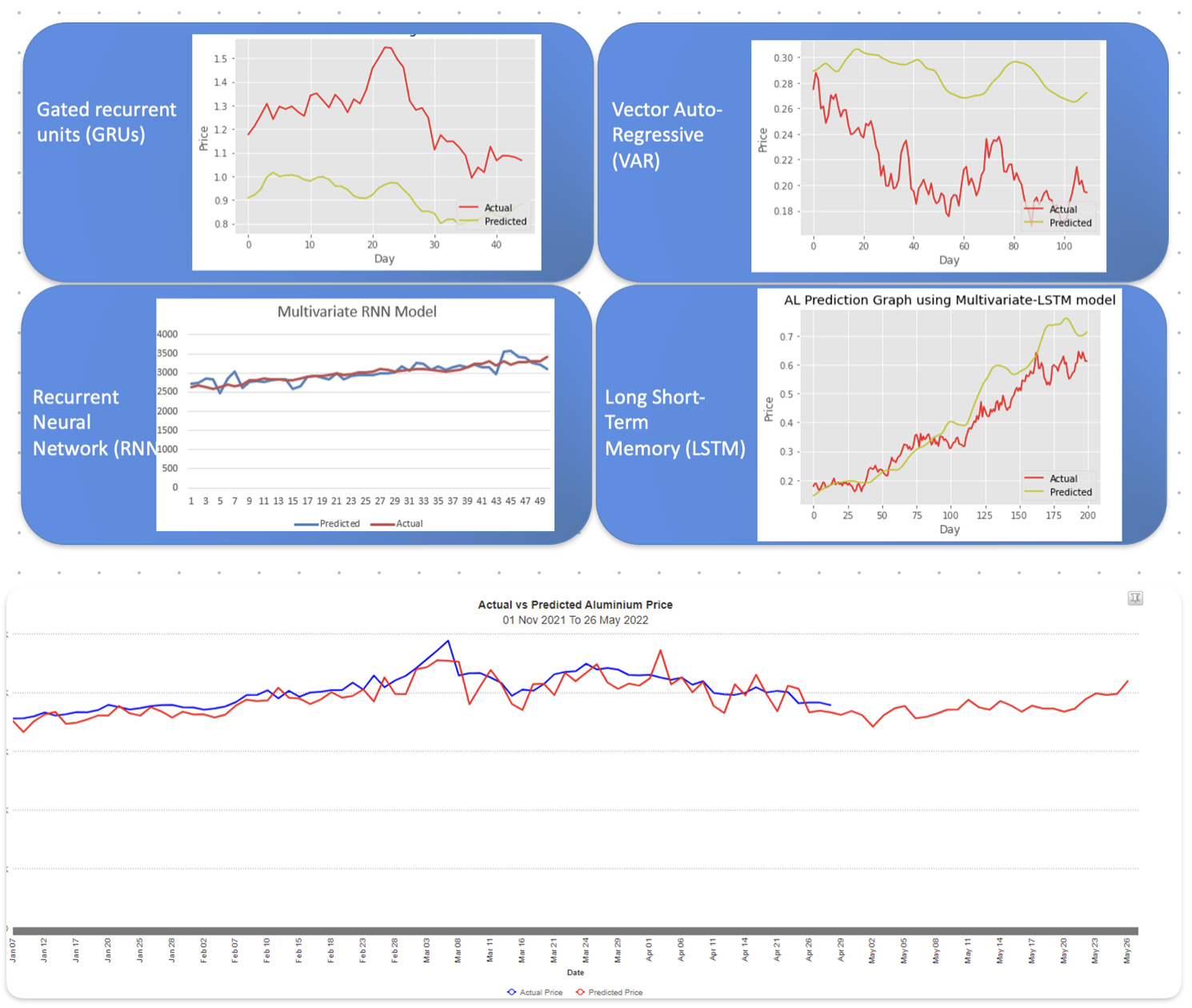

Commodity Price Forecasting

-

Timeline:

20 Days

-

Tech Stack:

Python

-

Demo Link:

-

Client Name:

Project Detail:

This project aimed at predicting commodity prices using advanced data science techniques. The overarching objective was to provide a reliable forecast irrespective of the market's inherent volatility, ensuring better planning and decision-making for businesses involved in commodity trading and commodity hedging.

Problem Statement:

The challenge lies in forecasting commodity prices in a market characterized by high volatility. Traditional models often fail to account for sudden market changes, leading to inaccurate predictions.

Solution:

We constructed a multivariate model that utilized data from various outsourced sources. By integrating diverse data points, the model was capable of comprehending the multifaceted nature of commodity markets. The results exhibited a 93% accuracy rate in general market conditions (8-12% volatility). Remarkably, even during periods of heightened volatility (up to 21%), the model maintained an accuracy of approximately 88%.

Features:

- Dynamic Dashboard: Real-time visualization of forecasts with historical data comparison.

- Adaptive Model: Adjusts to volatile market conditions to provide resilient accuracy.

- Data Integration: Capability to integrate and process data from diverse outsourced sources.

Use Cases:

- Commodity Traders: Enables traders to anticipate market moves and adjust their strategies accordingly.

- Financial Analysts: Provides a tool to better understand market dynamics and prepare more accurate financial forecasts.

- Supply Chain Managers: Assists in better procurement planning by anticipating price changes.

Data Science Specific Points:

- Data Collection: Data was aggregated from multiple outsourced vendors. This includes historical price data, global economic indicators, and other relevant factors influencing the commodity market.

- Data Analysis: We utilized a combination of time series analysis, deep learning algorithms, and traditional regression techniques to make sense of the diverse data.

- Results: Our multivariate model achieved an impressive 93% accuracy in general market conditions and maintained an 88% accuracy even in extreme volatility conditions.

Technologies Used:

- Python (for data processing and modeling)

- TensorFlow & Keras (for deep learning)

- Tableau (for dashboard visualization)

- Scikit-learn (for traditional machine learning models)

- SQL (for data storage and retrieval)

- Refinitive, Investing.com (for external data sourcing)